The Choosi Alternative Payments Report 2018

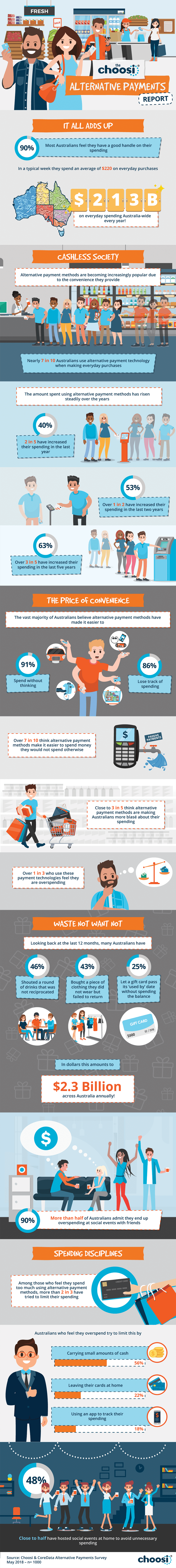

With the advancement of technology, the way we spend our money is becoming more convenient. Alternative payment methods like tap-and-go can prove to be beneficial, but how is the use of advancing technology affecting our finances and everyday lives?

The Choosi Alternative Payments Report is the eighth instalment in the Choosi research series, that explores the key barriers and drivers behind financial and social behaviour in Australia. This phase looks at the spending habits of Australians, and the emergence of alternative payment technologies.

Tap-and-go convenience

With two thirds (67.0%) of Aussies currently using alternative payment technologies, the days of rummaging through our wallet for spare change could very well be a distant memory in years to come. In fact, those who use alternative payment methods estimate that an average of 61.9 per cent of everyday purchases are facilitated by these methods.

The convenience of modern technologies such as tap-and-go is clear, with the proportion of everyday purchases made using alternative payment methods and the amount spent both increasing compared to a year ago (39.9% and 40.3% respectively) and five years ago (68.6% and 62.8% respectively).

Perhaps a downside of the added convenience, is the ease in which we can overindulge. More than seven in 10 (71.3%) respondents think alternative payment methods make it easier to spend money they would not have spent otherwise, and more than a third (34.4%) of those who use these methods feel they spend too much.

The research also sheds light on Australians overspending at social events, with over half (53.9%) of respondents saying they do this. Amongst those the reasons vary, with nearly a third (32.0%) say they do not want to look cheap in front of others and (30.3%) say they lose track of their spending.

Financial social etiquette

Shouting a round of drinks might not seem like a big deal, but more than three in five (61.8%) say they would re-think this if they knew how much it was costing them. Similar proportions feel this way when dining at expensive restaurants (54.8%) or exchanging expensive birthday gifts with friends (53.5%).

Interestingly, more than two in five (43.5%) admit they have avoided going to a social event in order to bypass awkwardness, and another 48.3 per cent have hosted social events at home in an attempt to avoid unnecessary spending.

Our spending habits can also have a negative effect on not only our bank account, but also on our relationships with our friends and family. More than a quarter (27.1%) of respondents have experienced fall outs with friends over money, with close to half (47.3%) admitting to these resulting in lost friendships. Family relationships are also affected, with more than a third (34.6%) of Aussies reporting they have been pressured or made to feel responsible for lending money to family. Among them, similar proportions say this made them feel annoyed (42.4%) or stressed (39.4%).

Putting aside feelings of stress and annoyance, there are great benefits of using alternative payment method technology, particularly when it comes to the convenience the various options can provide. We as a nation, are embracing these advancements and despite the perceived stumbling blocks, we still feel as though we have a good handle on our spending and are effectively managing our finances.

Stay tuned for the next chapter in our Choosi research series.

6 Jul 2018